Vanguard 2025 Fund Fact Sheet

Vanguard 2025 Fund Fact Sheet

Related Articles: Vanguard 2025 Fund Fact Sheet

- 2025 Porsche Macan: A Comprehensive Review

- Spider-Man 3: A Web Of Possibilities For 2025

- Days Until June 30, 2025: A Countdown To A Pivotal Milestone

- NFL Draft 2025: City Of Las Vegas Set To Host Annual Football Extravaganza

- June 2025 Calendar Planner: A Comprehensive Guide To Planning Your Month

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Vanguard 2025 Fund Fact Sheet. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Vanguard 2025 Fund Fact Sheet

- 2 Introduction

- 3 Video about Vanguard 2025 Fund Fact Sheet

- 4 Closure

Video about Vanguard 2025 Fund Fact Sheet

Vanguard 2025 Fund Fact Sheet

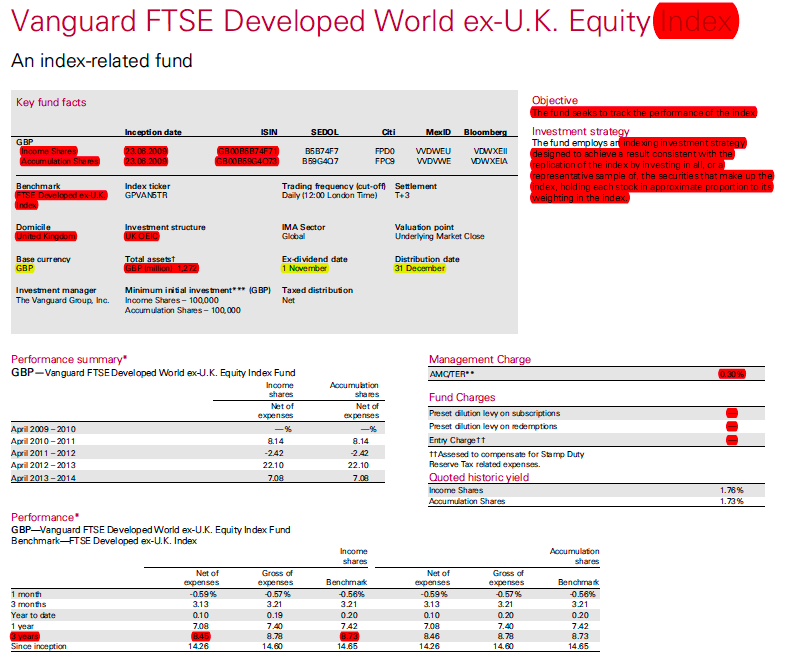

Investment Objective

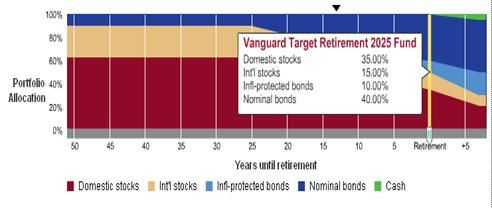

The Vanguard 2025 Fund seeks to provide long-term capital appreciation and income for investors who plan to retire around 2025. The fund invests primarily in a diversified portfolio of stocks and bonds that are expected to provide growth potential and income over the long term.

Key Features

- Target Retirement Date: 2025

- Asset Allocation: 60% stocks, 40% bonds

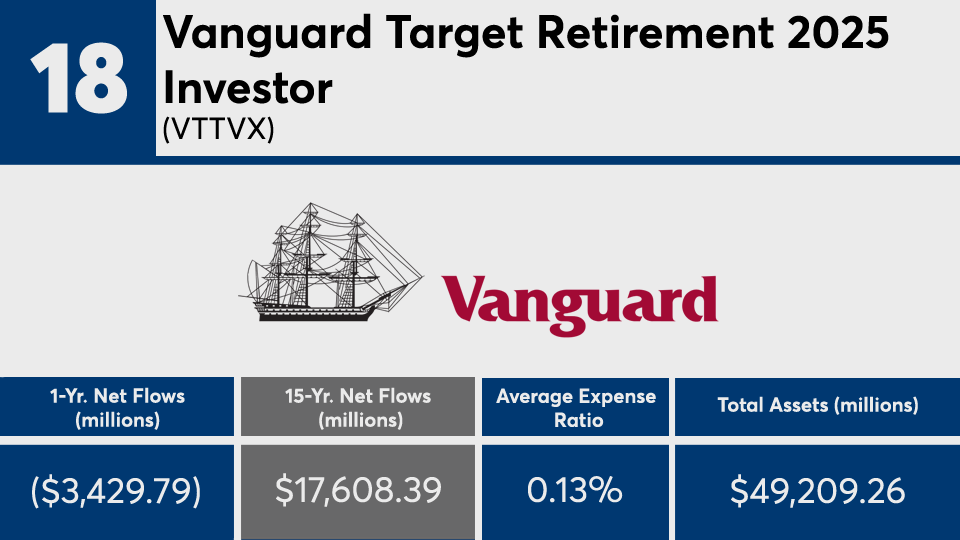

- Expense Ratio: 0.16%

- Minimum Investment: $3,000

Investment Strategy

The fund’s investment strategy is based on the belief that a diversified portfolio of stocks and bonds can provide investors with the potential for long-term growth and income. The fund’s asset allocation is designed to provide a balance between growth potential and income, and it is adjusted over time as the target retirement date approaches.

The fund’s stock portfolio is invested in a diversified mix of large-cap, mid-cap, and small-cap stocks. The fund’s bond portfolio is invested in a diversified mix of government bonds, corporate bonds, and mortgage-backed securities.

Performance

The Vanguard 2025 Fund has a strong track record of performance. Over the past 10 years, the fund has returned an average of 7.5% per year.

Risk Considerations

The Vanguard 2025 Fund is subject to the following risks:

- Market Risk: The value of the fund’s investments may fluctuate with the overall stock and bond markets.

- Interest Rate Risk: The value of the fund’s bond investments may fluctuate with changes in interest rates.

- Inflation Risk: The value of the fund’s investments may be eroded by inflation over time.

- Currency Risk: The value of the fund’s investments may fluctuate with changes in foreign currency exchange rates.

Fees and Expenses

The Vanguard 2025 Fund has an expense ratio of 0.16%. This means that for every $10,000 invested in the fund, $16 will be deducted annually to cover the fund’s operating expenses.

Suitability

The Vanguard 2025 Fund is suitable for investors who are planning to retire around 2025 and who are comfortable with the risks associated with investing in stocks and bonds.

How to Invest

You can invest in the Vanguard 2025 Fund through a Vanguard brokerage account. You can also invest in the fund through a retirement account, such as a 401(k) or IRA.

Additional Information

For more information about the Vanguard 2025 Fund, please visit the Vanguard website or contact a Vanguard representative.

Disclaimer

This fact sheet is for informational purposes only and should not be construed as investment advice. Please consult with a financial advisor before making any investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Vanguard 2025 Fund Fact Sheet. We appreciate your attention to our article. See you in our next article!